Yorkshire Wealth Services

Service Outlook

Wealth Building

Financial Planning

The financial plan is the driving document for our firm. This core document is such an important tenet of our firm and believe everyone must have this roadmap, that we waive the financial plan fee for our clients with assets under management.

Partnership

We partner with CPA’s and estate planning attorneys to make sure your financial security is watched over from the very beginning of our relationship. We also have an in-house notary service to ensure we can be a true “one-stop” shop for our clients.s.

Investment Management

Research and Risk Management

We not only utilize our own investment research in-house, but also leverage a team of analysts that provide research data and in-depth analytics for our portfolios.

Active Portfolio Management

We constantly look for opportunities for growth in our client portfolios. Unlike most advisor we are true active managers for our clients within our model strategies.

CryptoCurrency

Crypto Currency

We have extensive knowledge in the area of cryptocurrency and Bitcoin. Douglas has been in the cryptocurrency space for multiple years and is well-versed in this area.

Portfolio Allocation's

We are one of the few advisors that actively incorporate Bitcoin into our portfolio’s on a risk adjusted basis depending on the clients risk metrics, preference and other considerations.

Public Safety Member Services

Retirement Plans

Personal Strategies

Court Investment Services

Trusted Fiduciares

We are passionate about serving the legal community in a fiduciary capacity. We understand the difficulty and challenges in simply getting court accounts opened, and retitling investment accounts held at outside banks, brokerages, credit unions, transfer agents, and more.

The court process

We understand the challenges of servicing a court account and have a process for making it easy for you and your clients. Our attention to detail, knowledge of probate code, and high-quality customer service are unprecedented. We strive to simplify your situation while acting in your best interest to protect your assets.

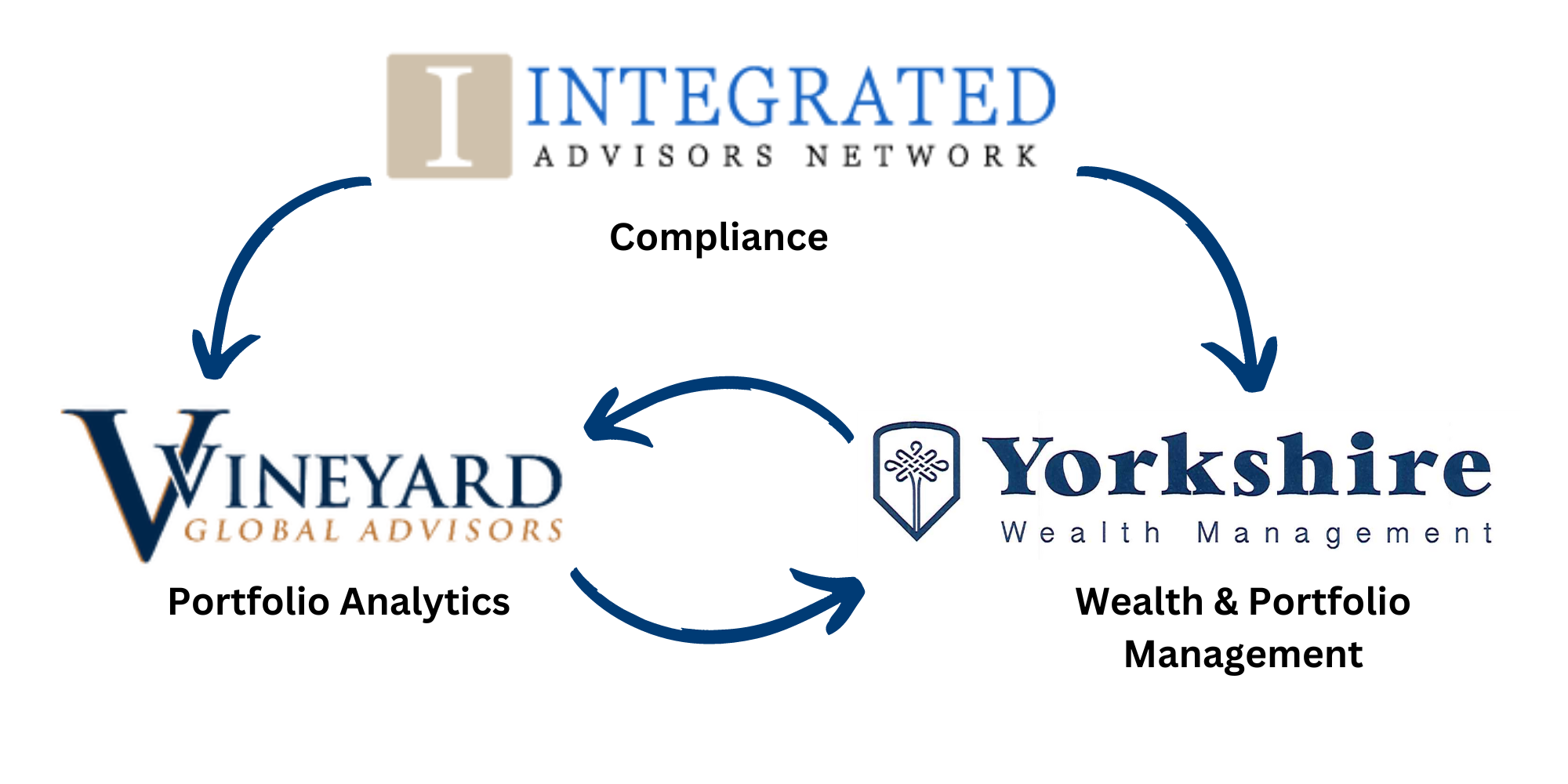

Does your advisor use generic mutual funds or only make changes when you meet? Our approach gives our client true active management with the support of our sister company Vineyard Global Advisors. Combined with the oversight of Integrated Advisors Network, we offer our clients unparalleled wealth management strategies and portfolio management.

Here is how our strategies have done

Premiere

$100k - $500K- 1.25% Annual Fee of Assets Under Management (AUM)

- Professional Investment Management

- Bi-Annual Financial Review

- Regular Account Statements by Mail

- Prompt Phone and Email Support

- Weekly Market Updates by Email

- Quarterly Financial Review

- Select Client Event Invitations

Gold

$500K-$1M- All Premiere services

- Discounted 1.0% Fee of AUM

- Complimentary Estate Plan Review with a Qualified Attorney

- Invitation’s to Client Events

- Comprehensive Financial Plan

Platinum

$1M+- All Gold services

- Discounted 0.85% Fee of AUM

- Financial Reviews as Desired

- Complimentary Tax Return Preparation

- VIP Access to Select Client Events

Our Office

16935 W Bernardo Dr

Suite 170

San Diego, CA 92127

Contact Us

(858) 798-5616

douglas.shultz @ ywmgmt.com

Office Hours

Mon-Fri: 9am - 4pm

Sat-Sun: Closed